Storm Damage & Homeowners Insurance: 5 Things You Need to Know

How your homeowners insurance coverages can help you rebuild after storm damage

Piles of mangled siding and shingles litter the once lively neighborhoods. You can't help but ask yourself, how will they ever recover?

Rebuilding after storm damage is no small feat and insurance is often what makes it possible. Here are five things you need to know about your home insurance when it comes to storm damage.

1. Your homeowners insurance may not cover water damage

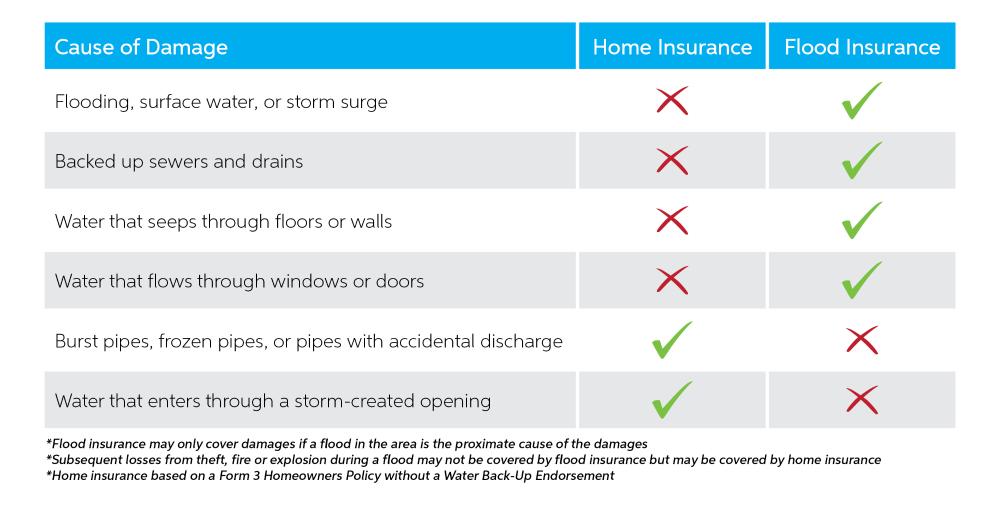

Water damage can devastate a home, especially after a storm. But, most homeowners insurance policies only cover certain types of water damage.

One of the major differences is how the water gets inside your house.

Water damage that originates inside your home or from a storm-created opening is typically covered by home insurance.

Examples may include:

- An overflowing washing machine

- A burst interior pipe

- Rainwater that enters your home through openings storm winds create

This is helpful for most household accidents and some storms, but not in the event of flooding.

Water damage from outside your home is usually not covered by home insurance.

Examples may include:

- Floodwater

- A broken water main

- Water that enters your home through manufactured openings

Unfortunately, these are the types of damages you will most likely have after a storm.

To cover these damages, you may need to add flood insurance to your home insurance policy. To add flood insurance to your home policy, talk to your local insurance agent.

Even if you don't live in a flood zone, it's a good idea to add flood insurance and it's usually very affordable. If you do live in a flood zone, you will want to make sure you have the coverage.

2. If your insurance claim is denied you may qualify for government assistance, like FEMA

If the government declares your town a federal disaster area, the Federal Emergency Management Agency (FEMA) may provide disaster relief.

- To qualify, you will first need to submit an insurance claim. If your insurance company approves your claim, they will pay it, not FEMA.

- If your insurance doesn't cover the damages, the insurance company will deny your claim. This is where FEMA steps in.

- Next, you need to submit the FEMA paperwork and documentation, which you can complete online. You will need to include a formal denial of your claim from the insurance company.

- Your agent will be able to provide you with formal denial paperwork to meet FEMA's requirements.

- FEMA may provide compensation for most of your damages if your insurance doesn't cover it.

3. You can save money with a common loss deductible

If you experience a severe storm, chances are that more than your home will have damage.

What about your car?

How about your belongings boxed up in the basement?

Different insurance policies cover these items. In the past, this meant you paid multiple deductibles. Now, most insurance companies, including Auto-Owners Insurance, offer a common loss deductible.

4. If somebody else's property damages your house during a storm, you are likely still responsible

What happens if your neighbor's tree falls onto your house and damages your roof during a severe storm? Or, what if your fence blows over and dents your neighbor's car during a period of high wind? Who is responsible?

The general rule for insurance is that your property is your responsibility. This usually includes trees that fall onto your property.

So, if a neighbor's tree damages your property during a storm you are responsible. Your home insurance policy will most likely cover your damages.

But, things may change if the tree is dead or dying before the storm. In that situation, the owner of the tree may be responsible for your damages.

5. Your house must be "unfit to live in" to receive reimbursement for temporary relocation

After severe storm damage, your home may be unsafe to live in. If this is the case, your home is "unfit to live in".

Determining if your home is unsafe after a severe storm can be difficult. Most claims departments try to determine whether a home is fit to live in on a case-by-case basis.

For example, if your roof blows away in strong winds, your home may be unsafe. But, if your basement floods and needs time to dry, you may be able to safely stay in your home.

If your home is unfit to live in, some home insurance policies cover the cost of temporary relocation and other living expenses. This may include living expenses you incur during your home repairs or until you find a new house.

You may need to make the decision to temporarily leave your home before talking with your insurance company. If you do leave your home, make an honest assessment to determine if it's unfit to live in - especially if you expect your insurance company to pay for your expenses.

Examining your current insurance coverages for potential gaps is critical. Talk with us today to prepare your family before disaster strikes.

Disclaimer: The analysis of coverage is in general terms and is superseded in all respects by the Insuring Agreements, Endorsements, Exclusions, Terms and Conditions of the Policy. Some of the coverage mentioned in this material may not be applicable in all states or may have to be modified to conform to applicable state law. Some coverages may have been eliminated or modified since the publishing of this material. Please check with your local Independent Auto-Owners Insurance Agent for details.